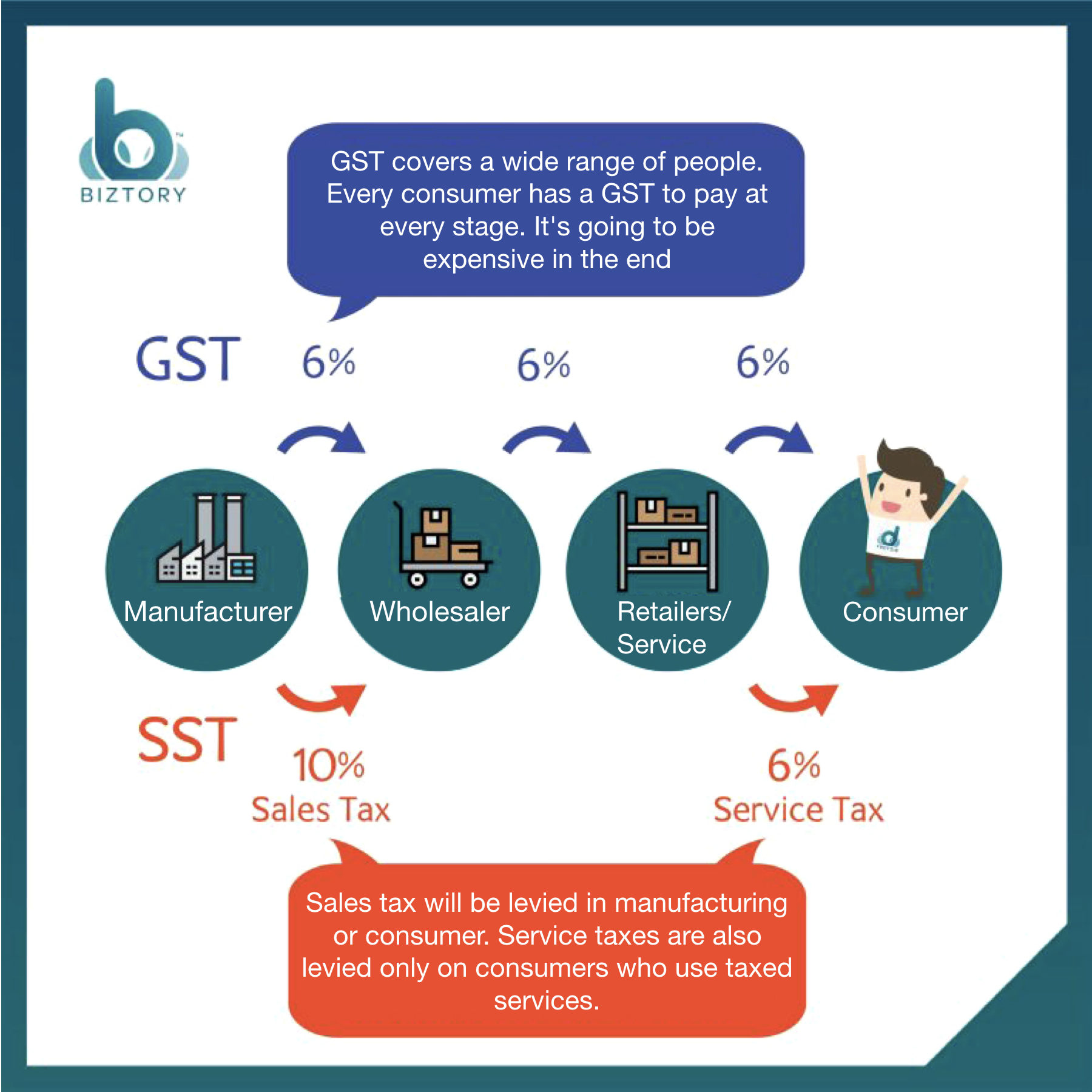

And 6 for services and GST standard rate of 6 are forms of a consumption tax in which SST is a single-stage tax while the GST is a multi-stage tax. The differences between GST and SST.

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

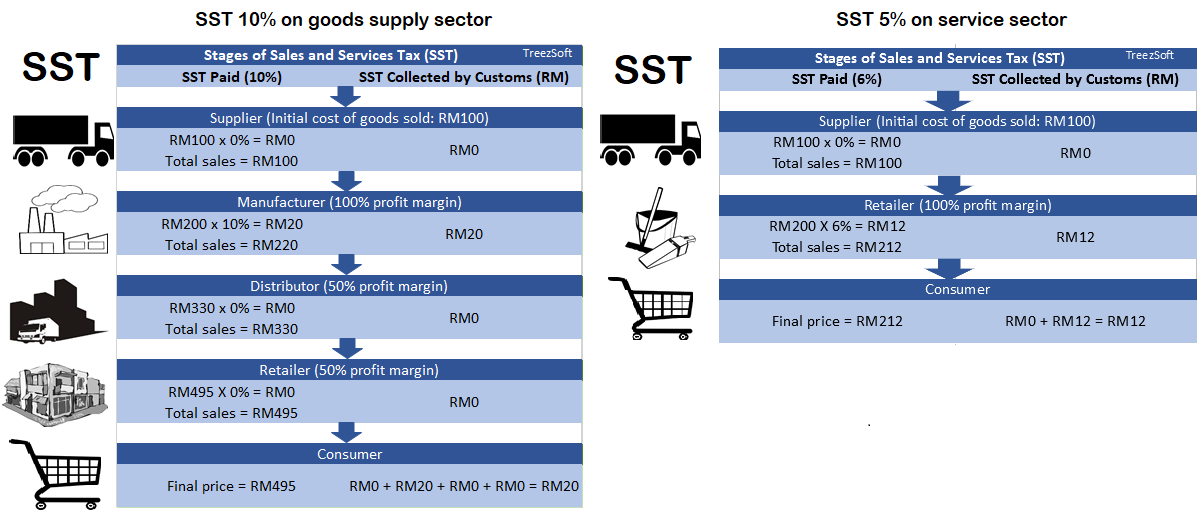

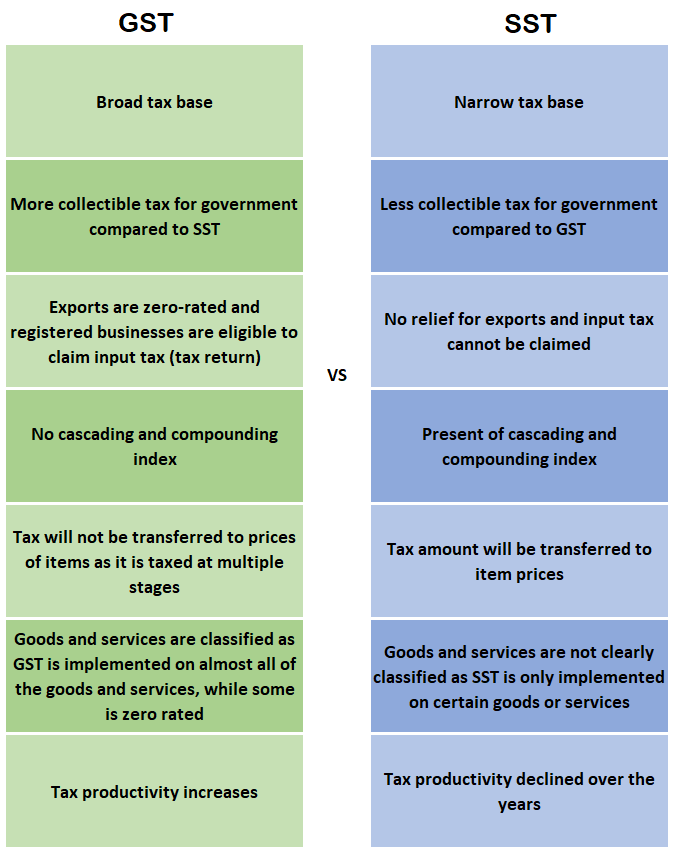

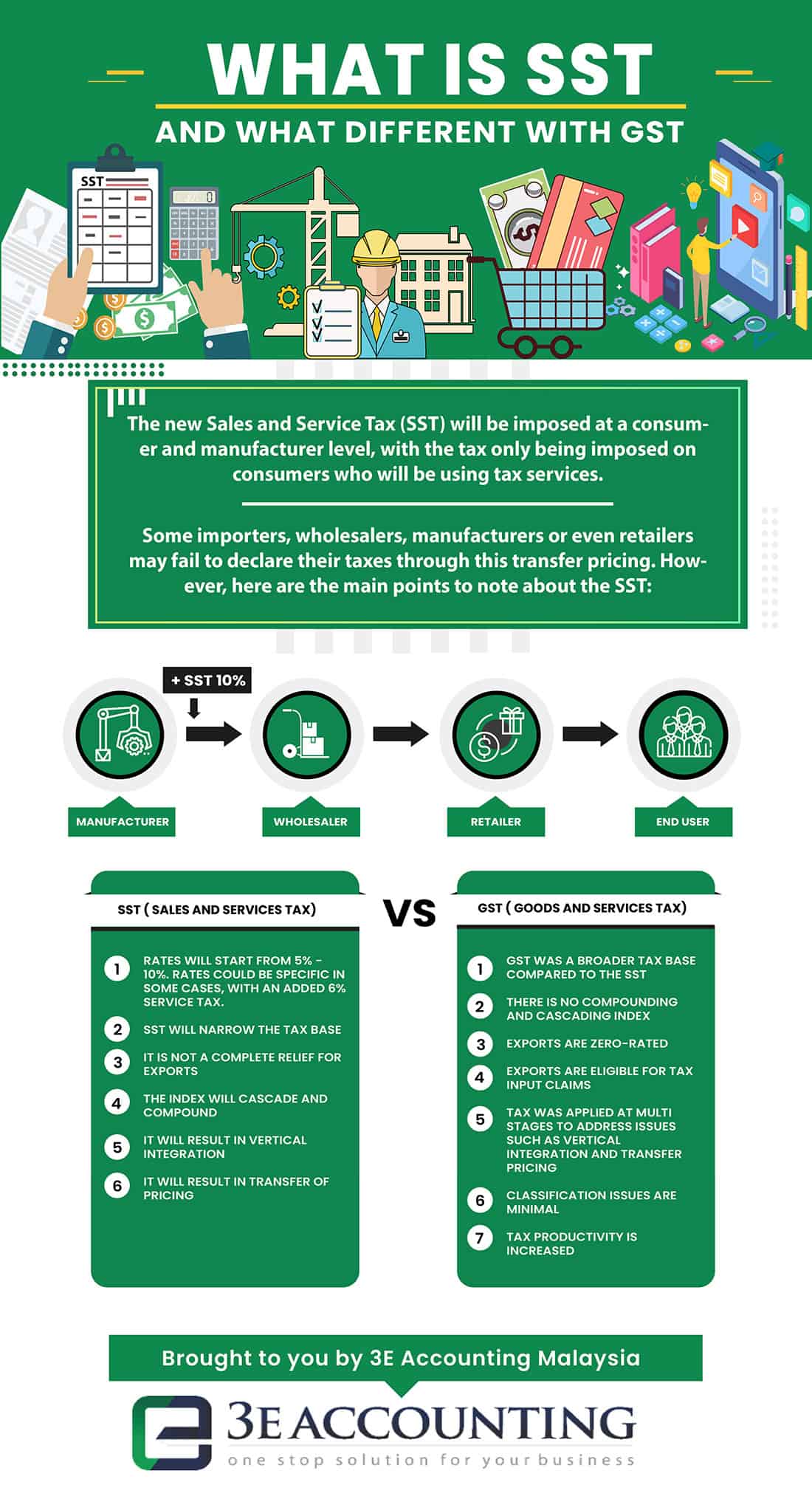

. In conclusion we all now know that the SST 10 for sales. The Goods and Services Tax GST is better than the Sales and Services Tax SST as GST collection is more than the latter which benefits the government businesses and the rakyat as a whole said economists. The Sales and Service Tax SST reintroduction will be at a rate of 10 for the sales and 6 for the services.

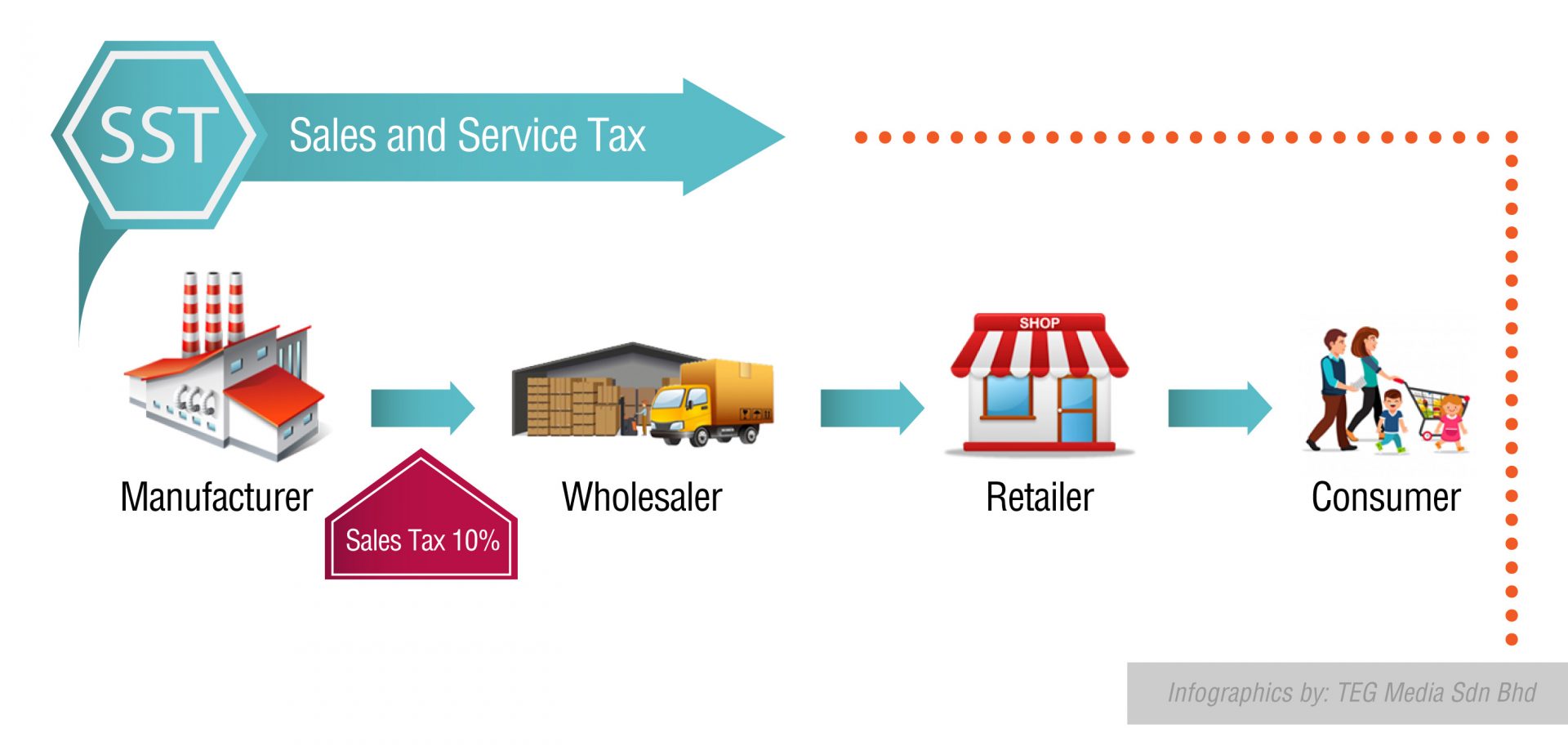

SST is a federal consumption taxation policy that falls under Sales Tax Act 1972 in Malaysia. Consumers will have a choice in their consumption by paying service taxes based on their. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

Goods and services tax to sales and service tax transition rules. Malaysia has approved the abolition of the Goods and Services Tax GST introduced three years ago. MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it.

It was replaced with a sales and services tax SST on 1 September 2018. GST vs SST is an argument commonly heard among Malaysians especially during the initial roll-out phase of GST in 2014-2015. 2018-08-12 - By DR CHOONG KWAI FATT MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in most goods and services.

GST stands for Goods and Service Tax and is implemented in Malaysia starting from 1st April 2015 to replace SST. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. SST vs GST in Malaysia.

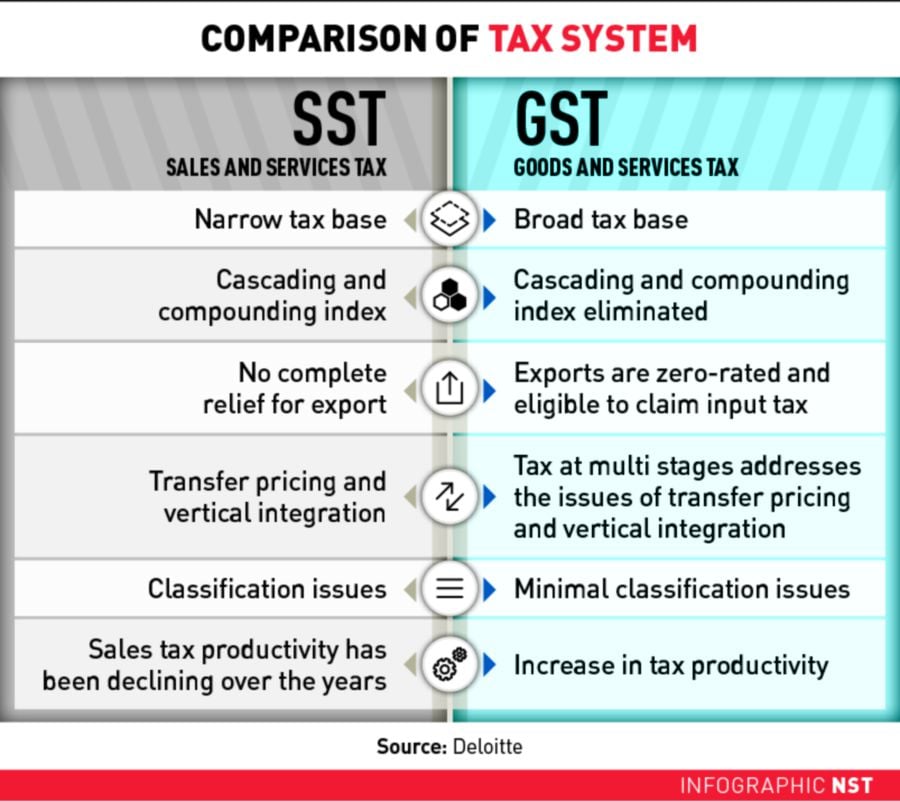

SST Only goodsservices that fall under the SST list are to be taxed. The SST has a smaller range of taxable items in comparison to the GST which was a wider range meaning that basically all goods and. Putra Business School Manager of Entrepreneurship and Community Development and Impact senior lecturer Dr Ahmed Razman.

Certain supplies are treated as zero-rated exempt or are subject to relief. Up to this day when this post is made people are still arguing and debating about it. MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in most goods and services.

The Finance Minister stated that the SST bill will be passed in Parliament at around August. Below is a summary of the points for taxpayers to consider during the transition period. Mandatory registration upon reaching a threshold of RM500000 voluntary registration also possible Sales Tax.

Homefinder Malaysia Malaysians are currently enjoying a three-month tax break between the zero-rating of GST and the re-introduction of SST. In effect it provides revenue for the government. The Star Malaysia.

Same goes for the GST although obsolete shortly after introduction it is also a taxation policy on most goods and services sold for regular consumptions. On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. We are only few months away from the implementation of the much talked about Goods and Services Tax GST on April 1 2015.

Sales and Services Tax applicable from Sep 1 2018 replaces itDeskera ERP will assist its customer remain compliant with applicable tax system. GST is a multi-stage 6 Goods And Services tax that is charged. A license had to be obtained if annual sales turnover exceeded RM100000.

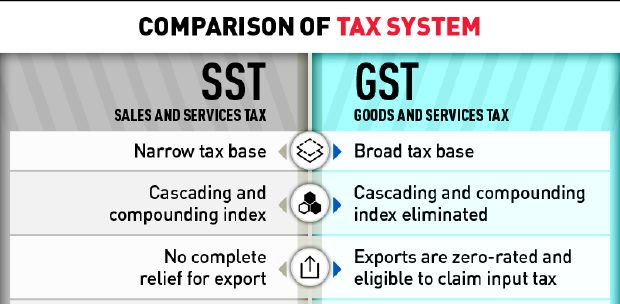

GST is also charged on the importation of goods and services into Malaysia. Comparison Between SST and GST. The Malaysian government replaced GST with SST as of September 1 2018.

The battle between GST vs SST is real. The announcement was made by Lim Guan Eng Finance Minister on 16th July 2018. GST stands for Goods and Services Tax while SST stands for Sales and Service Tax.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018. GST is a value added tax imposed on goods and services sold for consumers. Here are some major differences between the GST and the SST that you should know as a business owner.

Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed. This tax will be replacing the Sales and Services Tax SST which is a single stage of consumption tax where businesses cannot recover the tax paid on. Find out everything you need to know about SST in Malaysia as a small business owner.

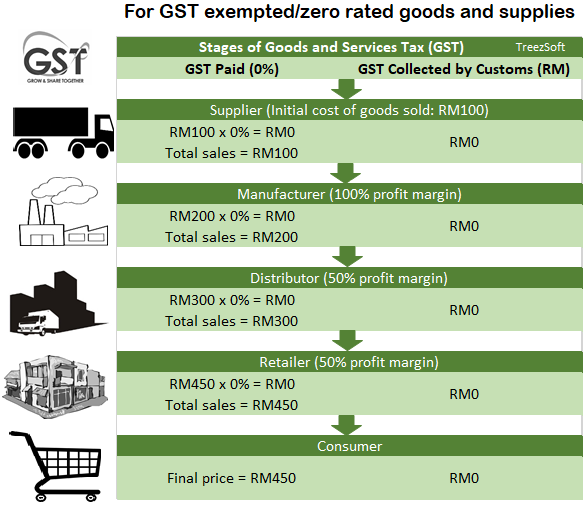

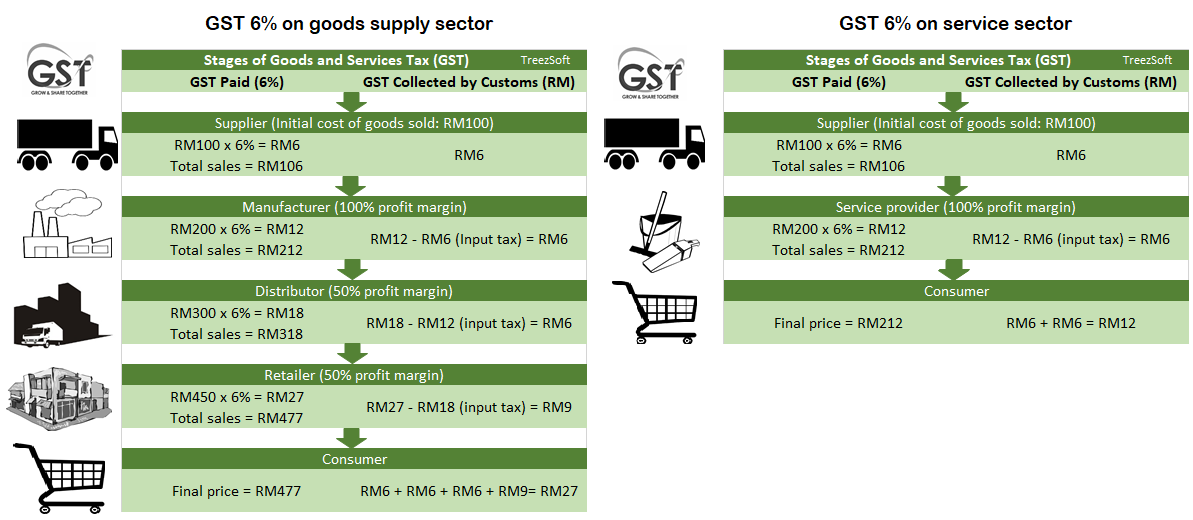

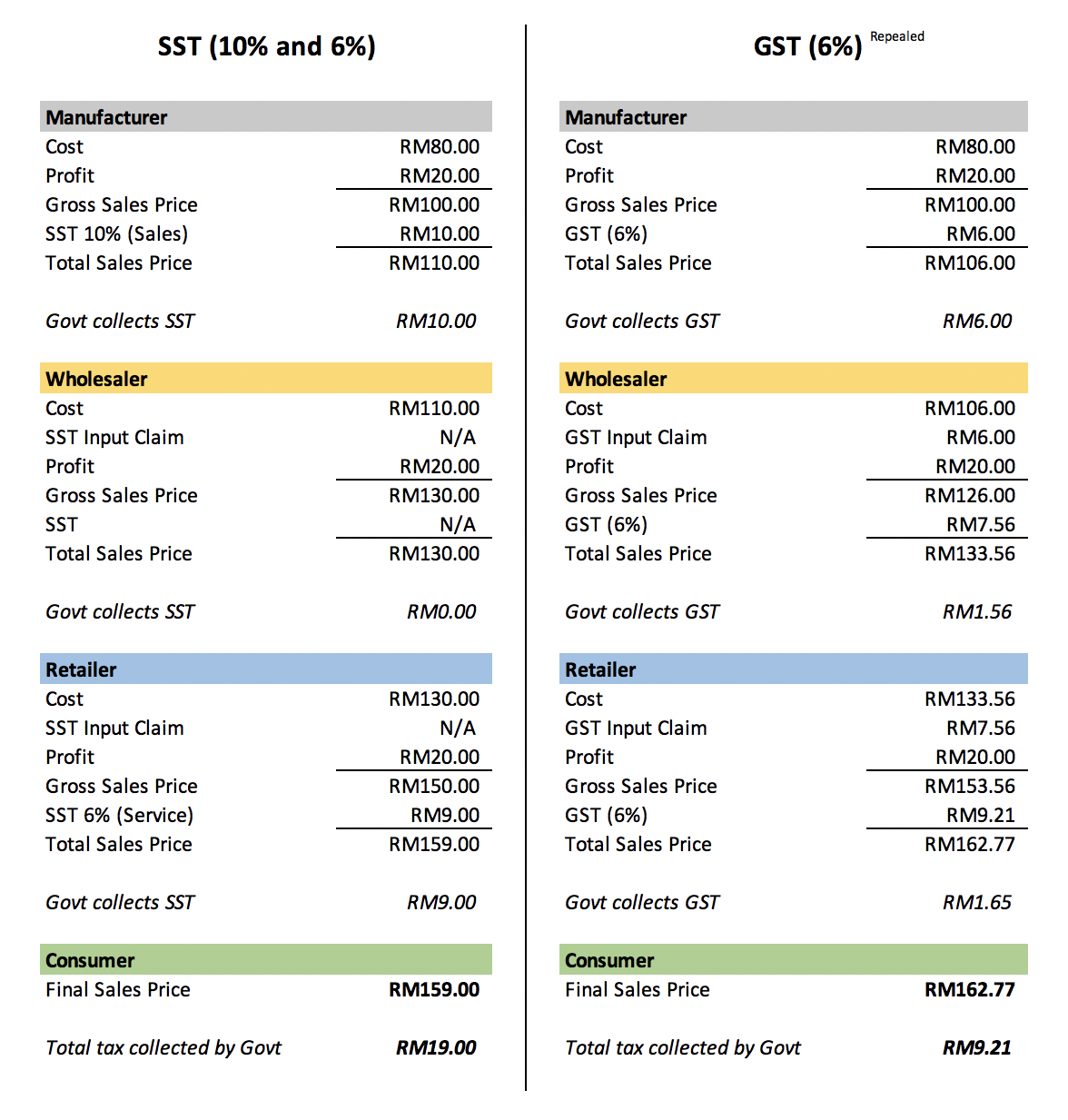

An example below shows the differences between SST GST we have made certain simplistic assumptions for demonstration purpose. Thu Feb 05 2015. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted.

Please refer to the table below for a comparison of two tax system. Goods and Services Tax GST is a form of multi-layer tax introduced by the Malaysian Government in 2014. Its the first time since the Seventies when the Service Tax Acts 1975 that there isnt any kind of consumption tax imposed but as the government has been saying from the start it will end.

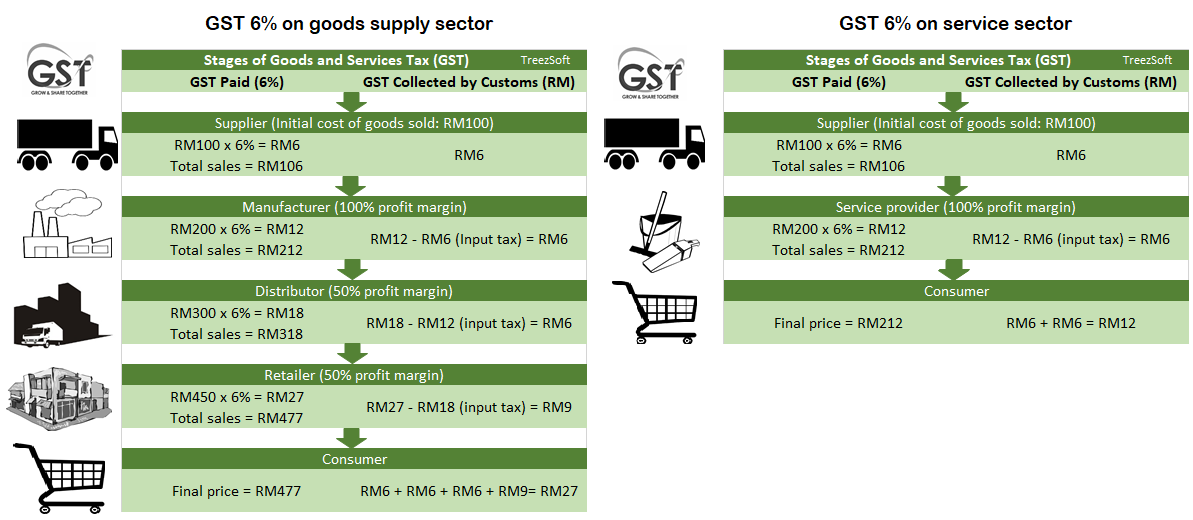

Supplies made between 1. Kaygarn No Comments. It is applied to all level of the production chain refer to Figure 1 hence it is often referred as.

How SST VS GST in Malaysia can be evaluated. GST vs SST became one of the hottest debate topics among the politicians from the government as well as the opposition. You need not to be part of any political divide to have an opinion on the Malaysian tax system because any sort of tax system.

The GST regime has been in place since April 1 2015. Exempted supplies zero-rated GST relief of GST. The standard rate of tax.

GST All goods and services are subject to GST except.

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Gst Vs Sst A Snapshot At How We Are Going To Be Taxed

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Vs Sst In Malaysia Mypf My

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia Gst Vs Sst Minding Your Business The Economics Society

Gst Better Than Sst Say Experts

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sst Vs Gst How Do They Work Expatgo

Gst Vs Sst In Malaysia Mypf My

Gst Vs Sst In Malaysia Mypf My

How Is Malaysia Sst Different From Gst

Gst Better Than Sst Say Experts News Summed Up

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst Better Than Sst Say Experts

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Vs Sst Which Is Better Pressreader